“banks won’t extend credit because good borrowers don’t want to borrow”

"banks won't extend credit because good borrowers don't want to borrow"

While Megan Wilson is so over all of the cute lists circulating on Facebook ... the reason I continue to use it are for posts such as the following from my friends (they really are friends too, not just "friends") Jim and Jenny in St. Paul:

Account Representatives

Corporate Management

Public Relations

Capital One Corporation

1680 Capital One Dr.

McLean, VA

22102-3407

February 13, 2009

To Whom it May Concern:

We are writing to express our outrage at a communication we received today from your bank. It informed us that the interest rate on our Capital One MasterCard Platinum account, number 5XXX-4XXX-3XXX-0XXX, which we had carefully maintained in good standing for many years, is being raised from 5% to 13.9%. This is unacceptable.

How can an American financial institution act in such an irresponsible fashion at this time of crisis? We will not be using your services any longer. We may now be forced to cancel our plans for an addition on our home, depriving others of their livelihoods. Having a decent -- a fair -- credit rate is critical for our household, other responsible borrowers like ourselves, and for economic activity in the United States of America.

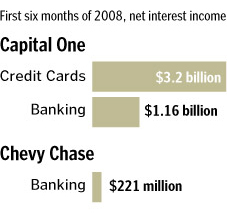

The ready availability of funds backed by we, the tax paying citizens of our Nation, at interest rates lower than ever seen before, should make the provision of credit to regular borrowers cheaper. At $3.5 billion so far, Capital One is in the Top Ten of TARP banks. Instead we see this predatory response. President Obama's call for a new era of responsibility has clearly fallen on deaf ears.

Now we know that the line "banks won't extend credit because good borrowers don't want to borrow" is simply a lie. We hope our elected officials are listening, and we have taken this opportunity to convey copies of this letter to our elected representatives as well as those in the area of your corporate headquarters in Virginia.

To these responsible elected officials we say: It is time to use the proper force of law to stop these out of control banks. Without immediate and targeted intervention, ordinary households and businesses will simply cease to function as economic agents. Cash on hand will not stop this economic collapse. We must have lending on reasonable terms.

Bank loan officials need to immediately be replaced with public officers behind the lending desks, as was done under Roosevelt's Reconstruction Finance Corporation in the 1930s; the same RFC that appointed many bank's officers in those days (read the history of many banks and you will find their founding presidents were RFC appointees). Unfortunately, it took the Hoover and Roosevelt administrations over four years to discover this policy option. Tragically, it appears it may take just as long this time around.

Regardless of any other economic or fiscal policy measures that may need to be taken, acting to get public agents behind lending desks is the only way to prevent today's bank lending strike from continuing to severely damage the United States. Today, any large bank that curtails credit is the equivalent of a hundred small bank runs and collapses in the 1930s. This is what turned the crash of 1929 into the Great Depression: Bank runs. Now we have a bank lending strike, and failure to recognize and combat it can only have the most dire consequences.

The bankers' strike of today is as dangerous as any railroad strike or bank run ever was; it should be broken at once. Perhaps the wealth and manners of the strikers render them beyond our system's ability to combat the threat; in this we can only pray for responsible and courageous political leadership.

To the account representatives at Capital One: Immediately cancel our account and never contact us again. Thank you for your attention to this matter.

Please convey this letter to your management, their management, and Capital One's senior management. Nearly tripling a simple consumer line of credit's interest rate, at this time and under these circumstances, is immoral and dangerous, and demonstrates the need for vigorous government intervention in banks' decision-making personnel.

May God have mercy on our Nation.

Sincerely,

Jim and Jennifer Turnure

St. Paul, Minnesota

Cc Representative Betty McCollum, Minnesota

Senator Amy Klobachar, Minnesota

Representative James Moran, Virginia

Senator Mark Warner, Virginia

Senator James Webb, Virginia

Governor Timothy Kaine, Virginia

Attorney General Robert McDonnell, Virginia

President Barack Obama